A Theory of Site Engagement, Investigators Relationship Infrastructure, and the Future of Clinical Development Platforms

Let’s start from the beginning — what is a CRM?

A Customer Relationship Management (CRM) system is a structured application that allows commercial teams to track, optimize, and manage how a company engages with its most valuable asset: its customers.

In simple terms, a CRM is two things:

It helps you interact with your customers (system of engagement), and

It helps you catalogue those interactions (system of record).

Salesforce, the world’s most well-known CRM, serves as the system of record for sales teams, capturing every interaction with a physician, payer, or provider.

CRMs can go beyond that to enable data visualisation → Reporting

Now — what is a site?

A site is the atomic unit of clinical development. It’s where trials happen, patients are enrolled, protocols are executed, and data is born. Every pharma pipeline, every commercial launch, every regulatory approval traces back to a site.

So why Yendou?

Yendou was built on the observation that the commercial function of pharmaceutical companies obsessively tracks HCP activity to create tailored, data-driven experiences that drive revenue. In contrast, the R&D function has no equivalent infrastructure to manage relationships with investigators and sites.

The result? No company today has a centralized, structured overview of the quality of its relationships with sites and investigators — despite the fact that delays in clinical development (and ultimately commercialization) are overwhelmingly driven by site performance.

Low site performance — just another word for missed milestones — has two consequences:

Revenue is locked in the pipeline. Pharmaceutical companies have billions of commercial value trapped in their late-stage pipelines. Takeda, for example, has made this challenge visible:

They understand exactly where the bottleneck lies: clinical trial execution.

Billions are incinerated in operational overhead. Pharma companies pour money into non–trial conduct activities — the so-called "white space": the prep work required to initiate clinical trial conduct at the site level and achieve First-Patient-In.

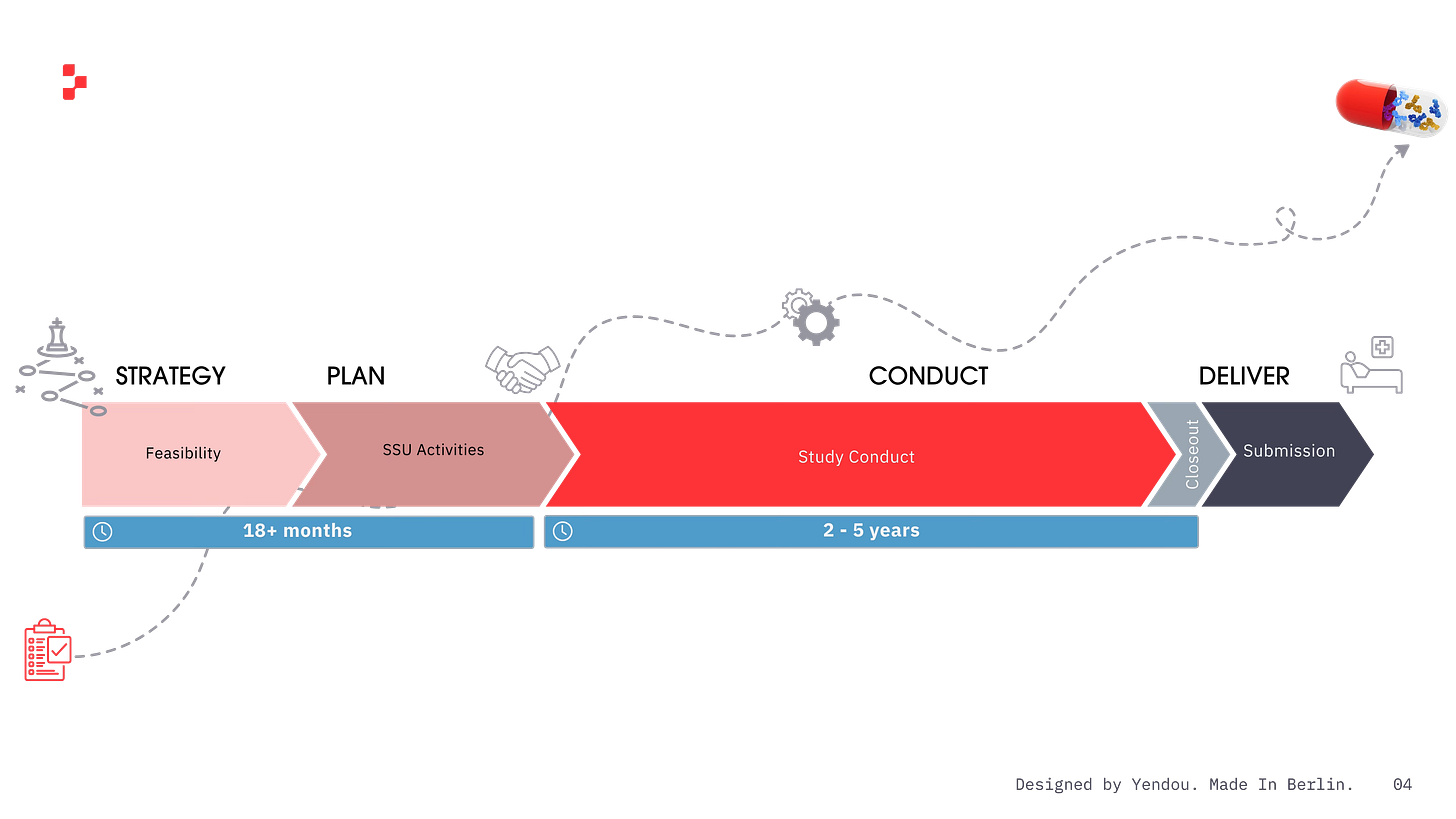

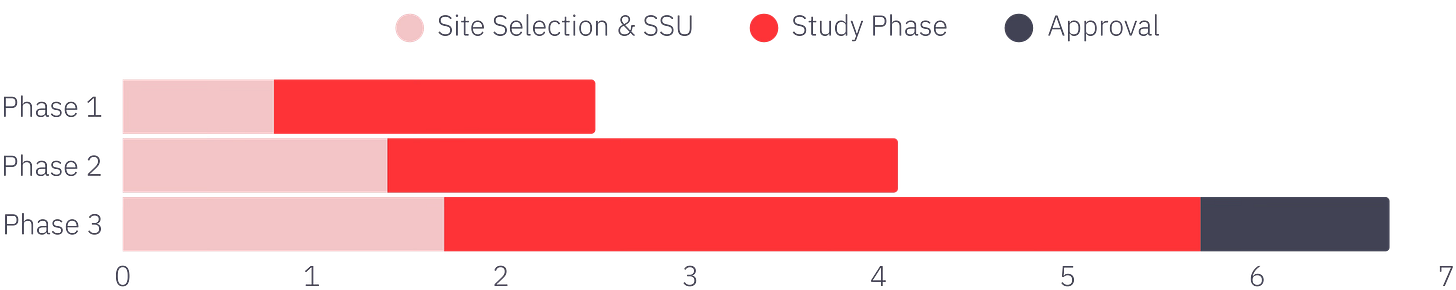

According to IQVIA’s latest analysis, site selection and startup (SSU) — work that is heavy on PI and site engagement — consumes 45% of total development timelines.

So — what is Yendou?

We’re building the Salesforce of Clinical Operations: a platform designed to engage and manage relationships with the most overlooked — but highest-leverage — asset in R&D: the investigators and the infrastructure they operate in.

To do that, we need to define a new category:

What is a Site Engagement Platform?

To oversimplify: a Site Engagement Platform provides an opinionated framework for how sponsor-site relationships should be managed and operationalized at scale. It is to clinical development what CRM is to sales.

Remember what a CRM does:

It helps you interact with your customers (system of engagement), and

It helps you catalogue those interactions (system of record).

Applied to clinical development teams, a Site Engagement Platform:

Helps you interact with your investigators and research sites (system of engagement),

Catalogues those interactions (system of record), and

Yes there is a third point. Crucially — helps you understand the quality of those relationships (system of intelligence).

This is why Yendou isn’t a Site-as-Customer CRM. It’s an SEP.

If CRMs became the interface between sales teams and healthcare professionals, Site Engagement Platforms are becoming the interface between sponsors and research sites. And because the industry skipped the CRM era entirely, Site Engagement Platforms leapfrog it — the same way AI-powered search is leapfrogging traditional Googling.

Yendou is that platform. As of 2025, the only one.

Why a System of Intelligence is Non-Negotiable in Clinical Development

In sales, CRMs track the volume, velocity, and value of deals. It’s about understanding who’s buying, when, and why. But in clinical R&D, the stakes are higher, the variables messier, and the cost of inefficiency existential.

The goal is not to close a deal — it’s to activate the right site, recruit the right patients, execute the right protocol, and generate high-quality data.

This requires more than contact tracking. It requires a system of intelligence that understands how relationships impact operational execution.

Site selection demands real lift: investigator expertise, site infrastructure, staffing, standard of care, patient flow, past performance — and this intelligence is buried in PDFs, spreadsheets, email chains, and phone calls. Each piece is a microtransaction of effort.

So the question becomes: if your team invests in collecting this intelligence — where does it go? Can it be reused? Can it improve the next trial? Even the whole pipeline?

Too often, the answer is no.

That’s the hidden cost. Without a system of intelligence, you burn time collecting data that doesn’t compound. There’s no memory. No learning. No optimization.

Meanwhile, rising R&D costs and tighter market windows demand that companies understand how work gets done — not in theory, but in real execution:

Which tasks take the most time?

Why?

Who completes them?

What drives the variance across sites?

Without internal benchmarks, companies default to industry averages — averages that don’t reflect their team, processes, or trial complexity. That’s like trying to run a Formula 1 team using Uber data.

A system of intelligence changes this. It tracks how your team engages with sites, and how sites respond in kind. It listens to frequency, method, and responsiveness across communication — and surfaces the friction. It captures the actual effort it takes to move from feasibility to activation. It reveals bottlenecks inside your own operations.

It does this without changing how teams work — it simply listens, learns, and adapts.

That’s the leap: From system of record → system of engagement → system of intelligence.

It’s what lets you move faster, reduce waste, and de-risk commercialization.

And it’s what makes Site Engagement Platforms not just a smarter CRM — but the first true infrastructure layer for clinical operations.

Architecting the System of Intelligence

A real system of intelligence must go beyond static dashboards and one-off forecasts. It must learn how work gets done — and continuously evolve.

It has three core components:

1. Reactive Intelligence (the rearview mirror):

Tracks what already happened. Offers clarity on performance.

SLA and workflow tracking

Site engagement scores and relationship heatmaps

Team benchmarks by region, trial, task

2. Predictive Intelligence (the foresight engine):

Anticipates delays, risk, and inefficiency.

Site match predictions based on past performance

Forecasts for enrollment, delays, budget overruns

Suggests next-best-actions (e.g., prioritize Site X in Germany this week)

3. Adaptive Intelligence (the learning loop):

Learns from how teams work.

Analyzes interaction timing, methods, effectiveness

Correlates workflow types, personas and engagement style with site outcomes

Proposes better orchestration strategies

This is the operational memory. It builds internal benchmarks. It learns. It optimizes.

Together, these layers transform clinical ops from manual firefighting to dynamic orchestration.

Agentic AI in Drug Development

The future of work isn’t static dashboards or chatbots. It’s agentic AI — systems that act.

But for AI to act wisely, it must be trained on real data about how your team works:

How decisions are made across trials and roles

What patterns drive performance

Which workflows succeed under pressure

This is why systems like Yendou matter. They capture not just what happened — but how it happened. And that gives you a learning loop, not just a reporting layer.

With it, pharma companies can build custom copilots — AI agents trained on their unique operating logic. Ones that know:

Which sites are good partners

How to engage them

When to course-correct

The upside is massive: Trials move faster. Waste disappears. Execution becomes competitive advantage.

Because the next competitive frontier isn’t just molecule innovation. It’s operational intelligence — at scale.

This was a long article, so here’s a quick summary of what we discussed:

Site engagement data is one of the most important assets of your company. Without structured, actionable visibility into site performance and relationships, pharma teams are flying blind.

Executing blind means having billions in potential revenue trapped in late-stage pipelines. Resources are sunk into feasibility and SSU, consuming 30–45% of your timeline and commercialization potential.

Now, how can you get the infrastructure right?

Leapfrog the CRM era and invest in systems of intelligence. If you’re curious about how I look at it, my mailbox is always open. You need a system of intelligence because no one is stopping the era of agentic AI from coming — and you want to be prepared. To be well prepared:

The Next Era: Site Engagement Management (SEM)

Enter Site Engagement Management systems. SEMs don’t evolve from CRMs — they replace them.

They don’t just catalogue. They score, predict, prescribe. They learn how sites work and how teams work with them.

What This Means for the Future

Tomorrow’s AI systems will be built on today’s operational data. The winners will be those who invest early in intelligent infrastructure — systems that don’t just record, but learn.